https://www.irs.gov/coronavirus/frequently-asked-questions-about-the-employee-retention-credit#amending

Just to let you know that the IRS is hard at work checking for fraud!!!

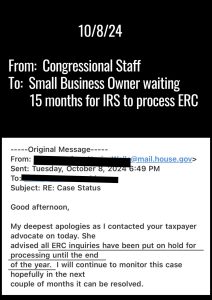

The tides are turning! Letter to IRS commissioner Werfel from members of congress; Wittman, Spanberger, Kiggins, Connolly, McClellan urging processing of ERC

Letter to IRS commissioner Werfel from Good, Higgins, Nortman Griffith who are members of congress, urging processing of ERC. Looks like congress is getting the message

Another congressman, Valadao sends letter to IRS commissioner Danny Werfel urging processing of ERC

So much for Taxpayer Advocacy, IRS form 911

IRS accelerates work on Employee Retention Credit claims; agency currently processing 400,000 claims worth about $10 billion

IRS Sued for Millions Over Employee Retention Credit (ERC) Delays

Reminder from Justin Elanjian CPA that it is imperative to contact congress

MTH Enterprises vs IRS

Ramirez Harvest Company Inc VS IRS. Another lawsuit for non-payment of ERC

Letters from Warren and Markey to Werfel, urging him to process ERC

IRS daring people to sue for ERC

Please write your representative

If you would like, resistbot sends emails to your representatives.

The number of characters is limited. Here is a letter you can use or alter that has the allowed number of characters: I’m writing this letter for two reasons:

1) The need to remove Danny Werfel as IRS commissioner

2) To request that you do not pass the ERC repeal act of 2024 The need to remove Danny Werfel as commissioner of IRS The functioning of the IRS is worse than ever When Danny Werfel was nominated for the position, he promised to protect the small business owners from an onslaught of audits instead he has done the opposite. It is the consensus of tax professionals that the IRS is worse than ever before.

Danny Werfel has failed to administer the ERC per the Cares Act law Tax professionals advised the IRS repeatedly to create a fraud protection plan. Had Werfel done this, the fraud would have been detected early. Werfel failed to administer proper protocols and then when he did something four years too late, he claimed credit for finding the fraud and then went on the falsely claim that all the rest of the ERC was fraudulent. Danny Werfel claimed that 70-80% was fraudulent. He was called out by tax professionals who knew that the IRS did not have the data to make that claim.

The IRS has been holding refunds that are shown on their own transcripts as due to taxpayers for years. The IRS has had many lawsuits filed against it for non -payment of refunds. These lawsuits are all requesting the IRS to pay for the legal fees of the plaintiff. In addition to wasting taxpayer money on legal fees, the IRS will have to pay 8% interest per year for the refunds they held. The Cares act required the IRS to promote the ERC but instead they vilified it and put it on the dirty dozen of Taxpayer scams. Werfel effectively, without support of the law, stopped the ERC filings by implementing a moratorium, fearmongering and unsupported statements about fraud.

The IRS sent out ERC disallowance letters randomly. Some of these letters failed to include the right to appeal. The taxpayer is supposed to be notified of their right to appeal.

Danny Werfel has:

- Failed or organize the IRS

- Failed to set up proper implementation of the Cares Act

- Failed to set up a plan to avert fraud on the ERC even after being advised several times by the AICPA

- Blamed others for his own errors • Falsely claimed that the majority of ERC claims were fraudulent

- Held up refunds

- Made the IRS agents non-responsive. (if you call, they won’t give any answers)

- Illegally created a moratorium

- Caused multiple lawsuits including APA violations of the IRS

- Harmed small businesses of America

The ERTC repeal act of 2024 The ERC should be extended to allow filing for AT LEAST the additional amount of time that the process was held up in a moratorium. I have many clients waiting for these refunds and they are on the edge of bankruptcy. These are the small businesses that make up America. Please take the time to listen to your constituents and understand from the level of the everyday people. Instead of listening to the claims of Danny Werfel, ask the tax professionals for their opinion.

Send Us A Message

What can we help you with?

Tax solutions tailored for you.

Michelle Smart, E.A.

Enrolled Agent

Licensed Tax Consultant C-90777

University of California Berkeley

Real Estate Agent